Recently, by way of a notification dated 27 October 2023 (Amendment), the Ministry of Corporate Affairs (MCA) amended the Companies (Prospectus and Allotment of Securities) Rules, 2014 (PAS Rules), inserting a new rule[1], to require every private company (other than small company and government company) (Private Company) to dematerialise all its securities, issue securities only in dematerialized form and permit transactions in securities only in a dematerialised form. Until now, only public companies were required to do this.

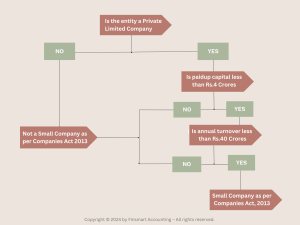

The Amendment is applicable to a Private Company as defined under the Companies Act except for: (a) small company, i.e., a private company with a paid-up share capital of INR 4 crores or below, and turnover of INR 40 crores or below; and (b) government company. In this context, it is relevant to note that there is no exemption for companies incorporated under section 8 of the Companies Act.

However, following companies are not eligible to qualify as Small Companies even though they meet both of the above conditions-

- A public company·

- A holding company·

- A subsidiary company·

- Company registered under section 8 of Companies Act, 2013·

- A company that is governed by any particular act

In this article, Finsmart Accounting – trusted in India for outsourced accounting and compliance – will list out all the critical details on dematerialisation of securities for private limited companies. Let’s start by understanding the timeline for compliance!

Timeline for compliance:

Every private company, which is not a small company as on or after 31 March 2023, shall be required to comply with the new requirements within 18 months of closure of such a financial year (Compliance Date). Accordingly, the Compliance Date for every private company (other than a small company) as on 31 March 2023 would be 30 September 2024.

Compliance requirements:

With effect from the respective Compliance Date for a Private Company, the Private Company will be required to (a) issue ‘securities’ only in dematerialised form; and (b) facilitate dematerialization of all its securities.

Issue and buyback of securities:

Further, every Private Company while making any offer for issue of any securities or buyback of securities or issue of bonus shares or rights offer, shall ensure that before such offer is made, the securities of the Private Company held by its promoters, directors, key managerial personnel have been dematerialised. Accordingly, as a prerequisite to a Private Company proposing to invite new investments, the securities of the promoter, director and key managerial personnel of such Private Company will have to be dematerialised.

This is a major update in dematerialisation of securities for private limited companies rules.

Transfer of securities:

In the event any person holding any securities in a Private Company intends to transfer them, such person will have to dematerialize such securities before undertaking the transaction. This would require the buyer to also receive the securities in dematerialized form.

Private placement, bonus shares or rights offer:

In case any individual holding security in a Private Company, subscribes to any securities of such Private Company, whether by way of private placement, bonus shares or rights offer, then such individual is required to dematerialize all the securities held, prior to such subscription.

Recommended reading:

Tax software for small CPA firms

Everything about accounting outsourcing cost

Expert tips to maximize tax deductions

Everything about property development accounting

Relevant laws to comply with for dematerialisation:

Every Private Company will be required to ensure compliance with the Depositories Act, 1996 (Depositories Act), the Securities and Exchange Board of India (Depositories and Participants) Regulations, 2018 (SEBI D&P Regulations) and the Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993. Further, every Private Company shall submit Form PAS-6 (Half yearly return for reporting of shares held in Demat form) to the Registrar of Companies (ROC), along with the relevant fee, within 60 days from the conclusion of each half-year, duly certified by a company secretary in practice or chartered accountant in practice.

Pursuant to the Amendment, every Private Company is required to:

| 1. | Obtain the International Securities Identification Number (ISIN) for all existing securities issued by it; |

| 2. | Promote, propagate and facilitate dematerialization of all its existing securities by the holders of such securities; |

| 3. | Once the share capital of the Private Company is dematerialised, the Private Company must issue securities only in dematerialized form; |

| 4. | Ensure that prior to any issue of securities, all the securities held by its promoters, directors and key managerial personnel are held in dematerialised form; and |

| 5. | File form PAS-6 with ROC in the manner and within the time, as prescribed. |

Another major update in dematerialisation of securities for private limited companies rules for 2024.

Understanding Whether a Company is Small or Not

Penal Provision

Since no specific penalty/fine is prescribed under rule 9B, penal provisions as per Section 450 of the Companies Act shall apply, which state, “The company and every officer of the company who is in default, or such other person, shall be punishable with a fine that may extend to ten thousand rupees, and where the contravention is continuing, with a further fine that may extend to one thousand rupees for every day after the first during which the contravention continues

Share Dematerialisation of Securities Queries

Do you have queries regarding dematerialisation of securities or wish assistance with any other accounting or compliance query? Drop us an email on connect@finsmartaccounting.com to get answers to all your questions. We are the leading outsourced accounting services provider in India with deep expertise in accounting, payroll, compliance, India entry, financial controller, and more.

Don’t forget to check out our most subscribed services:

Outsourced financial controller services

India entry consulting services

Accounts receivable outsourcing services

India Business Head

Mrs. Dipali Phadke is a qualified Chartered Accountant with more than 20+ years of experience in the field of Accounting, Taxation and Payroll. She is the backbone of Company’s Operations and heads India Business at Finsmart Accounting