In the complex world of multinational corporations (MNCs), managing payroll is one of the most critical and challenging tasks, especially in a diverse and highly regulated market like India. Payroll involves calculating salaries, managing tax withholdings, ensuring compliance with labor laws, and more. For MNCs, the volume of employees and the intricacies of managing payroll across multiple regions further complicate the process.

In recent years, advanced technology has become a game-changer in streamlining payroll processing, offering companies the ability to enhance accuracy, efficiency, and compliance. This blog explores how MNCs in India can leverage payroll technology to improve their operations, the challenges of traditional payroll systems, and the key benefits of adopting modern payroll solutions.

The Complexity of Payroll for MNCs in India

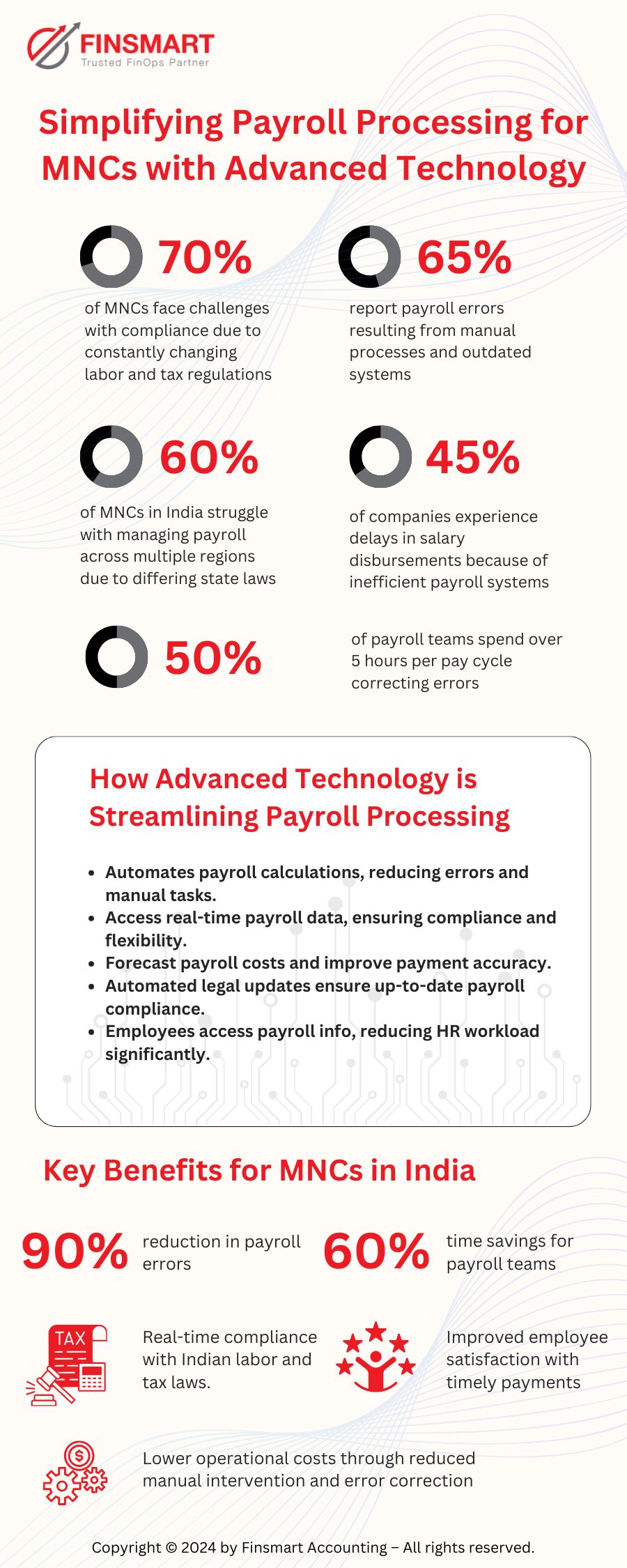

India’s regulatory environment adds layers of complexity to payroll management. The country has specific labor laws, tax regulations, and statutory contributions that must be adhered to. Some of the key challenges for MNCs include:

- Compliance with Indian Labor Laws: India has various labor laws that govern wages, working hours, gratuity, provident fund (PF), employee state insurance (ESI), and more. Non-compliance can result in penalties and legal repercussions.

- Tax Calculations and Deductions: MNCs need to ensure accurate tax calculations, including withholding income tax, professional tax, and managing different deductions based on state-level regulations.

- Employee Benefits: Companies must manage a range of employee benefits, including leave policies, bonuses, and health insurance.

- Manual Processes: Many MNCs rely on outdated systems or manual processes for payroll, which are prone to errors and inefficiencies.

- Multiple Locations: MNCs with employees across different states in India must handle diverse payroll regulations and tax implications.

Given these complexities, the need for an automated, centralized payroll system becomes essential.

The Role of Advanced Technology in Payroll Processing

Advanced payroll technology offers MNCs in India a way to streamline the entire process, improving accuracy, reducing errors, and ensuring compliance with local regulations. With automation, AI, cloud-based systems, and other cutting-edge tools, MNCs can transform their payroll processing.

Here’s how technology is reshaping payroll:

1. Automation and AI-Driven Payroll Systems

Automation eliminates manual intervention, which reduces the risk of human errors and speeds up the payroll process. AI-driven systems can automatically calculate salaries, deductions, bonuses, and more. They can also adapt to regulatory changes, ensuring compliance with Indian tax laws and labor regulations in real-time.

AI also plays a role in predicting trends in employee payments and benefits, which helps companies in budgeting and strategic planning.

2. Cloud-Based Payroll Solutions

Cloud-based payroll systems allow MNCs to manage payroll remotely and in real-time. Cloud solutions provide access to payroll data anytime and anywhere, which is particularly useful for companies with employees across different regions. It also ensures that all payroll data is securely stored, with automated backups and easy retrieval of historical data.

Moreover, cloud systems are scalable and can handle an increasing number of employees as MNCs grow.

3. Integration with Other HR and Accounting Systems

Advanced payroll solutions often integrate seamlessly with other enterprise systems like HR management and accounting software. This integration streamlines data sharing between departments, improves accuracy, and ensures that payroll data aligns with financial reporting and compliance documentation. Integrated systems reduce the need for redundant data entry and provide a comprehensive view of employee costs and financial health.

4. Self-Service Portals for Employees

Modern payroll systems often come with self-service portals, allowing employees to access their payslips, tax details, and leave balances online. This reduces administrative work for HR teams and enhances employee satisfaction by giving them more control over their personal payroll information. Self-service portals are mobile-friendly, allowing employees to access payroll information from their smartphones.

5. Ensuring Compliance with Local Regulations

One of the biggest advantages of using technology for payroll processing is the ability to stay compliant with India’s complex regulations. Advanced payroll software can automatically update to reflect changes in tax laws, labor laws, and statutory contributions. This minimizes the risk of penalties and ensures that payroll is always compliant with the latest regulations.

6. Analytics and Reporting

Advanced payroll software provides robust analytics and reporting tools. These tools allow MNCs to generate reports on payroll expenses, employee costs, tax deductions, and more. Companies can analyze trends, identify cost-saving opportunities, and ensure better financial planning. With data-driven insights, MNCs can make informed decisions about employee compensation, bonuses, and benefits.

Key Benefits of Streamlining Payroll with Technology

Adopting advanced payroll technology comes with a wide range of benefits for MNCs operating in India:

- Improved Accuracy: Automation reduces the chance of human errors, ensuring precise calculations for salaries, deductions, and taxes.

- Time Efficiency: By automating payroll, companies can save time on administrative tasks and focus on core business functions.

- Regulatory Compliance: Payroll systems stay updated with Indian tax and labor regulations, ensuring compliance and reducing the risk of fines.

- Cost Savings: Automating payroll reduces the need for extensive manual labor, leading to lower operational costs.

- Employee Satisfaction: Self-service portals and timely payments improve the overall employee experience, contributing to higher retention rates.

- Scalability: Cloud-based systems can handle increasing numbers of employees, making them ideal for growing MNCs.

Future of Payroll Processing for MNCs in India

The future of payroll processing lies in further advancements in AI, machine learning, and blockchain technology. AI and machine learning will enhance predictive payroll analytics, allowing businesses to forecast payroll costs and optimize their payroll processes. Blockchain technology can revolutionize the payroll industry by providing secure, transparent, and efficient ways of handling cross-border payments.

With continuous innovation, the payroll landscape for MNCs in India is set to become more efficient and accurate, allowing companies to focus on growth and development.

Conclusion: Finsmart Accounting’s Payroll Solutions

For MNCs looking to streamline payroll processing in India, Finsmart Accounting offers comprehensive, tech-driven solutions. By leveraging advanced payroll technology, Finsmart ensures accuracy, compliance, and efficiency in managing payroll for multinational companies. From automated salary calculations to handling complex tax deductions and regulatory compliance, Finsmart provides end-to-end payroll services that are tailored to the Indian market.

With Finsmart Accounting, MNCs can simplify payroll management, reduce operational costs, and focus on their core business objectives. By partnering with a trusted accounting service provider like F

Founder & Director

Shalaka Joshi, a Chartered Accountant passionate about outsourcing and problem-solving, brings over 20 years of extensive experience in accounting, payroll, and MIS reporting to her professional endeavors